13 Jul Q2 2021

Letter from the President |

Fellow CAV Angels –

As we head into the Summer and look ahead to the Fall, I couldn’t be more pleased (and cautiously optimistic) with where things are trending, both at the organizational level and the macro-environment. Many of us are readjusting to life without masks, the prospect of less restrictive travel, and resuming in-person meetings and events. While inflation is an ever-present spectre these days, the markets are still hitting new highs. Perhaps due to this sense of “reemergence” from over a year of pandemic lockdowns, or the acute desire for something other than the status quo, CAV Angels continues to flourish in both membership and investment activity. After a press blitz and Alumni Career Center educational seminar in the first quarter, our membership has spiked to 175 members (a 35% increase over 2020), spread somewhat evenly across the three membership tiers: student, educational, and full (i.e. accredited investor). Notably our educational members – speaking to a core tenet of CAV Angels’ mission – has surged 100%, doubling to 34 from 17. This is also a key driver of future full memberships, given our short term history of educational members “upgrading” once they see an interesting deal or upon qualifying as an accredited investor. Our members have invested over $3,400,000 in 9 companies year-to-date…a historical high for CAV Angels and more than we invested last year in total. Needless to say we are off to a great start for another record year!

To ensure that this growth continues, but also not losing sight of our brand cultivation and core educational programming, the board and executive committee recently committed to refreshing the vision and mission of CAV Angels, as well as formalizing some aspects of our deal funnel process to enhance the transparency to founders and engagement of our members. Additionally our Founders Advisory Council and Healthcare Advisory Council are taking shape under the guidance of chairs Bryan Simms and Dr. Jim Daniero, respectively. I look forward to sharing updates with you soon on all of these efforts, and in the meantime wish everyone a safe, healthy, and active summer!

Wahoowa,

Paul Nolde

President, CAV Angels

Note from the Co-Chairs

CAV Angels Members and Friends of CAV-

As Paul has highlighted, we are excited by the growth in membership and funding we are experiencing and thank you all for your support of both CAV and the UVA entrepreneurial ecosystem. This quarter we facilitated investments of $1.5MM in 4 deals, including the TearSolutions bridge note offering that closed in early July. The other closed deals were Brandefy (affordable beauty), Domusys (prop-tech) and Trilogy Mentors (SaaS mentoring platform). These deals bring our total for the first half of 2021 to $3.4MM, which tops our full year 2020 total.

Our pipeline is healthy with Cerillo (miniaturized, affordable lab instrumentation) having already pitched to our members, and all indications pointing to a July group investment. Nanochon (3D-printed orthopedic implant and tissue scaffold), BetterWorld (SaaS not-for-profit fundraising tools) another Galant Challenge winner, LytosTech (green fungicide), Micronic Technologies (clean water) and Karios (sprayable hydrogel that prevents cardiac adhesions) are in various stages of advanced due diligence.

On the administrative front, all three (Babylon, Micronic and ARtGlass) of our applications for the State of VA Angel Credit have been acknowledged and we await final paperwork that will enable us to move forward. We expect K-1s for 2020 for these and other CAV entities to start flowing later in July into mid-August.

I hope you enjoy the rest of our Q2 newsletter, including exciting updates from Babylon, GO, Brandefy and MITO. I also would like to recognize rising 2nd years Nicole Krolak and Emily Cheng, our summer interns who are helping us bridge to the start of the next academic year when we expect the arrival new student members, new investment opportunities, another virtual Alumni Association pitch featuring some of our star portfolio companies and a CAV Angel in-person meeting in NoVa to further fuel our momentum.

Enjoy the summer!

Jim and Rich

Late Update & Time Sensitive

We closed on our investment in TearSolutions bridge notes in early July, adding 13 new members to CAV-TearSolutions LLC.

We are in the process of finalizing our member interest in Cerillo (miniaturized, mobile and affordable plate reader) and will be forming CAV-Cerillo LLC to enable this group investment in their convertible notes.

Both Nanochon and BetterWorld diligence reports are in their final stages and are likely to pitch to members this month or early next month.

Q2 and H1 2021 Deal Activity

|

TearSolutions $468K (early July close) H1 total $3,412K |

|

Cerillo- miniaturized, lower cost mobile plate reader (lab instrument)

Sunny Day Fund- inclusive employee benefit plan to encourage and enable savings for emergency expenditures (direct investment by CAV members- closes in July)

Nanochon- 3D-printed orthopedic implant and tissue scaffold

BetterWorld- SaaS tools for not-for-profit fundraising

LytosTech- follow-on from prior direct investment – green fungicide for high value crops (grapes & strawberries)

Karios- sprayable hydrogel that prevents post-surgery adhesions

Micronic Technologies- follow-on raise to enable our portfolio company to address the promising landfill leachate market opportunity with their clean water technology

Galant Challenge

Brandefy, an affordable beauty dupe app founded by double Hoo Meg Pryde, was one of five Galant Challenge winners in May. Other winners included udu, BetterWorld, Brave and Kudos.

Brandefy, an affordable beauty dupe app founded by double Hoo Meg Pryde, was one of five Galant Challenge winners in May. Other winners included udu, BetterWorld, Brave and Kudos.

In addition to the $175,000 they were awarded from the competition, Brandefy received $1.7M from their oversubscribed seed round.

BetterWorld, a social impact venture, seeks to assist businesses and nonprofits as they serve their communities. They were awarded $250,000 from the Galant Challenge, and they will be pitching to Cav Angels’ members in Q3

Babylon

2021 has been off to an exciting start for Babylon Micro-Farms. After receiving 4M in capital and grants this spring, they hosted an open house at the end of June, where Richmond mayor Levar Stoney welcomed them to the capital. Check out this article from iGrow for more details on the event and the company’s plans for expansion.

Additionally, Chip Blankenship, a CAV Angels and CAV-Babylon LLC member, has been named to Babylon’s Board of Directors. Alexander Olesen commented that Chip was the perfect fit for what the company was seeking to add to its board.

(Pictured above – Rich Diemer-CAV-Co-Chair at the Babylon Grand Opening in Richmond)

MITO Material Solutions Goes Commercial

MITO Material Solutions is shipping out 1kg of material to Folsom Skis, their first commercial customer. MITO’s purpose is to design polymer-strengthening additives that enhance product performance.

CAV Angels invested $250k into Series Seed Q3 of 2020, and we are thrilled to see MITO and its co-founders, Haley and Kevin Keith, thrive.

In their May newsletter, RTM VitalSigns announced that they received an additional three US patents for their respiratory monitor. They are continuing to collect and analyze respiratory monitor data, both from volunteers in their lab, and from their human clinical trial at Thomas Jefferson Hospital, using the information to fine-tune RTM algorithms. Additionally, they have recently submitted two NIH grant applications in order to optimize their cardiac and respiratory monitors.

|

GO, a social media app seeking to connect people in the post-pandemic world, is CAV Angels’ largest investment to date. The 24 members of CAV-GO LLC invested a total of $1,2MM into the company, showing just how much promise our group recognizes in it. Keep an eye out for a feature in UVA Today anticipated in the upcoming weeks. |

CAV/Mayo Cohort

The following students collaborated on the due diligence report that was presented to the CAV Angels Executive Committee which ultimately resulted in the CAV-Brandefy LLC investment in Meg Pryde’s affordable beauty company

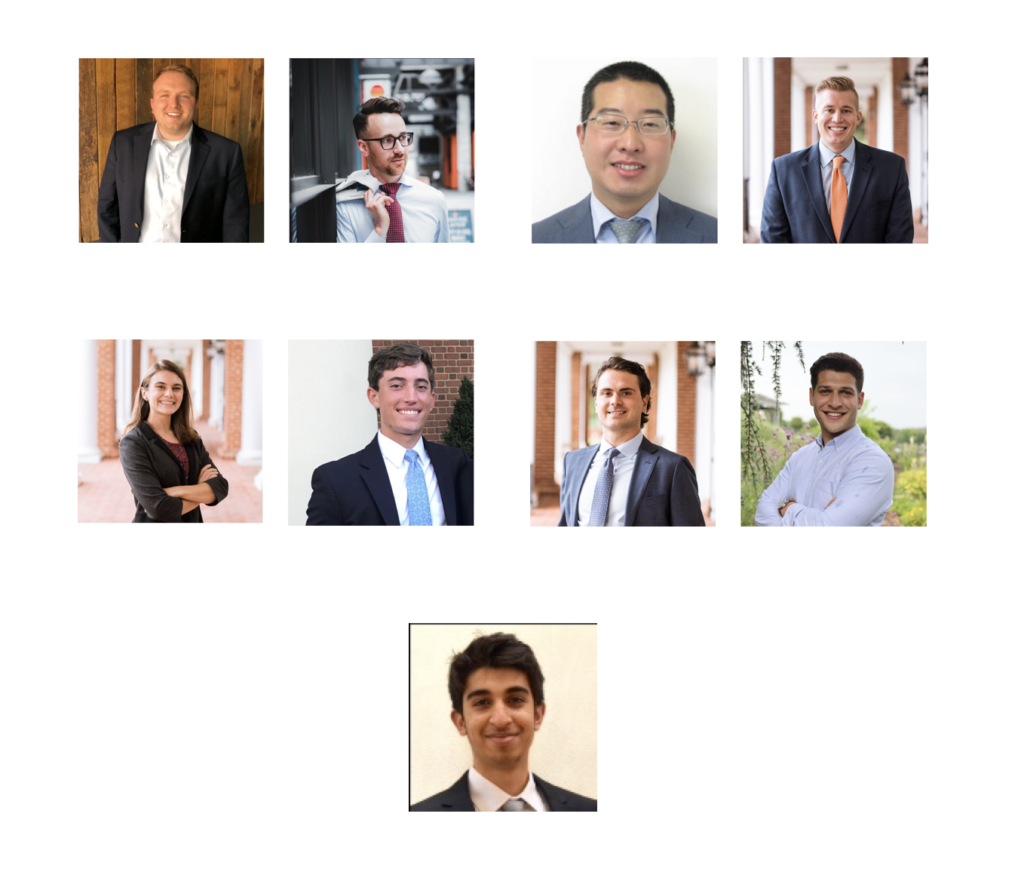

Pictured from left to right, top to bottom: Steven Valdez, Ben Ansell, James Kim, James Nish, Kerrin Kinnear, Sutton Blanchard, Matt Killian Alejandro Waquin, and Rishi Abichandani Rachel Edwards and Lauren Wippman, featured below, also played key roles in leading the Brandefy and GO due diligence teams respectively.

CAV Angels -- Team Member Spotlight

Adriana Gadala-Maria is a Miami, FL native and a rising 2nd year at UVA Darden, where she is the President of the Entrepreneurship and Venture Capital (EVC) Club. She is currently a Managing Partner at Dorm Room Fund, First Round Capital’s student-run VC firm, and she spent the last year interning at Anorak Ventures and Glynn Capital. Prior to starting her MBA, Adriana spent 10 years building strategic partnerships for tech companies including TechCrunch, Crunchbase, and Code3 (FKA SocialCode). Adriana started her career at Reddit in 2011, where she was an early employee and drove sales partnerships with brands like Coca-Cola, eBay, and Netflix.

Adriana joined CAV Angels in September 2020 and helped perform diligence for CAV Angels’ 2021 investment in DataClassroom. She believes CAV Angels’ membership was invaluable to her career growth by giving her exposure to VC diligence work, insight into investment committee meetings, and mentorship from CAV’s executive team.

Upon completing her MBA, Adriana aspires to continue working in VC and to support founders in scaling their startups.

Outside of her studies and VC work, Adriana is a cooking enthusiast and loves discovering local vineyards in Cville with her husband and new pup, Penny.

Lauren Wippman is a rising second year at the University of Virginia Darden School of Business. Prior to Darden, Lauren spent four years in luxury hospitality and three years in early-stage startup operations. During her time at Four Seasons Hotels and Resorts, Lauren worked in operational roles at two different properties, including the flagship hotel in Washington, D.C. She then moved out west to Seattle and worked for Rover.com, a D2C dual-marketplace start-up, where she managed two different teams on the adjacency side of the business. In addition, she led the entire Customer Care department at a Series B start-up called Crowd Cow. At Darden, Lauren has taken on several leadership roles, including the Vice President of Venture Capital for the Entrepreneurship and Venture Capital (EVC) Club. Moreover, Lauren has thoroughly enjoyed her experience at CAV Angels, where she was able to execute on diligence for multiple companies, including diligence and deal execution for Team Go, which led to CAV’s largest investment to date. Her time at CAV prepared her extraordinarily well for her summer internship at Sands Capital Ventures, where she is focused on early-stage investing in the technology sector.

Rachel is a rising second year at the UVA Darden School of Business. Prior to Darden, Rachel worked for 10+ years in fashion and retail. Rachel spent the last 4 years working with startups in addition to founding her own business in 2018. Rachel joined CAV Angels in early 2021 and ran point on due diligence that subsequently led to CAV’s investment in Brandefy. She describes her experience with CAV as an excellent opportunity to connect with entrepreneurs and gain perspective on early-stage companies through the diligence process. While at Darden, Rachel continues to pursue her interest in venture capital, building experience with both early and later stage investments. During her spring semester, Rachel interned as a venture associate with North Haven Capital, a healthcare focused growth equity fund. This summer, she joins the UVA Licensing and Ventures Group as a Seed Fund Associate.